Additive Manufacturing Market Soars at 21.6% CAGR | Top Growing Players: Proto Labs, Stratasys

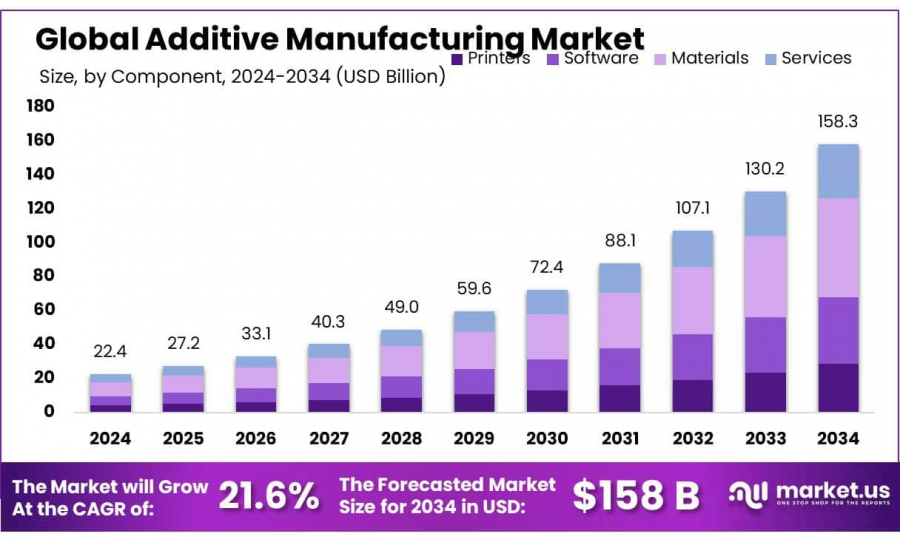

Additive Manufacturing Market size is expected to be worth around USD 158.3 Bn by 2034, from USD 22.4 Bn in 2024, at a CAGR of 21.6% from 2025 to 2034

NEW YORK, NY, UNITED STATES, January 22, 2025 /EINPresswire.com/ -- Additive manufacturing (AM) Market involves the creation of objects by adding material layer by layer, which is distinct from traditional manufacturing that often requires cutting away excess materials. Over the last decade, the adoption of additive manufacturing has grown exponentially, not only for prototyping but also for the production of end-use parts. The flexibility of this technology allows for the customization of products to individual specifications, reduction in waste materials, and significant cost savings in material and production processes. The market is increasingly recognized not just as a tool for product development but as a vital component of modern manufacturing strategies.

Demand for additive manufacturing is burgeoning across several key sectors. In aerospace and defense, stringent performance and safety standards drive the need for Additive Manufacturing technologies capable of producing complex components that meet exact specifications. In the automotive industry, the push towards electric vehicles and the need for lighter and more efficient parts has catalyzed the adoption of Additive Manufacturing methods. Consumer goods and electronics markets also increasingly rely on Additive Manufacturing for the rapid prototyping and customization of new products. As companies across these industries seek more agile and cost-effective solutions for production, the demand for additive manufacturing is set to escalate further.

Recent Technological Advancements in additive manufacturing technology have significantly broadened its applications and increased its appeal to traditional manufacturers. Improvements in 3D printing speeds, along with the expansion of available materials—including advanced polymers, metals, and composites—have enhanced both the quality and durability of manufactured products. Innovations such as the integration of artificial intelligence (AI) with 3D printing processes are optimizing production efficiency and quality control, making additive manufacturing more reliable and scalable.

One major growth area is the development of large-scale printing technologies, which are expected to transform industries such as construction and large industrial manufacturing. Furthermore, as the technology matures, there is a growing trend towards the establishment of additive manufacturing as a service (AMaaS), which provides companies with access to Additive Manufacturing capabilities without the need to invest in expensive equipment and specialized expertise. This model not only lowers the barrier to entry for many firms but also expands the reach of additive manufacturing into markets previously considered inaccessible.

Key Takeaways

1. The Additive Manufacturing Market is projected to reach approximately USD 158.3 billion by 2034, up from USD 22.4 billion in 2024, growing at a Compound Annual Growth Rate (CAGR) of 21.6%.

2. Materials account for a significant portion of the additive manufacturing market, holding over 36.10% of the global share.

3. Powder Bed Fusion (PBF) technology is predominant in the market, securing more than 32.10% of the global additive manufacturing market share.

4. Prototyping remains the most common application of additive manufacturing, capturing more than 54.30% of the market share.

5. The Automotive & Transportation sector is a major user of additive manufacturing, representing more than 24.60% of the global market share.

6. North America continues to be a leader in the additive manufacturing space, holding over 38.6% of the global market, valued at approximately USD 8.6 billion.

Additive manufacturing Statistics

By Component Analysis

In 2024, materials dominated the additive manufacturing market, capturing over 36.10% of the global share. This growth is driven by continuous advancements in material development and the widespread adoption of additive manufacturing across industries such as aerospace, automotive, healthcare, and consumer goods. The rising demand for diverse materials, including polymers, metals, ceramics, and biomaterials, has surged as companies increasingly leverage 3D printing to manufacture highly customized and complex components.

By Technology Analysis

In 2024, Powder Bed Fusion (PBF) maintained a dominant position in the additive manufacturing market, capturing over 32.10% of the global share. This technology is widely adopted for its ability to produce complex geometries with high precision and superior surface finish, making it essential in aerospace, automotive, and healthcare industries. The growing demand for high-performance, custom metal parts has fueled its expansion, with steady year-on-year growth observed from 2020 to 2024. As industries prioritize efficiency and material waste reduction, advancements in laser systems and powder materials are expected to further drive the adoption and performance of PBF technology.

By Application Analysis

In 2024, prototyping dominated the additive manufacturing market, capturing over 54.30% of the global share. This growth is driven by the increasing demand for rapid prototyping across industries such as automotive, aerospace, consumer goods, and healthcare. Companies are leveraging 3D printing to develop accurate, cost-effective prototypes that can be quickly tested, modified, and iterated, significantly reducing design cycle times and accelerating time-to-market for new products.

By End-use Analysis

In 2024, the automotive and transportation sector captured over 24.60% of the global additive manufacturing market share. This growth is fueled by the rising demand for rapid prototyping, lightweight parts, and custom components. Automotive manufacturers increasingly use 3D printing to streamline production, reduce material waste, and improve vehicle performance. The capability to quickly prototype new designs and produce on-demand spare parts has been instrumental in driving the adoption of additive manufacturing in this industry.

Key Market Segments

By Component Analysis

1. Printers

—— Desktop Printer

—— Industrial Printer

2. Software

—— Design

—— Inspection

—— Printing

—— Scanning

3. Materials

—— Polymer

—— Metal

—— Ceramic

—— Bio Materials

4. Services

By Technology Analysis

1. Material Extrusion

—— Liquid Deposition Modelling

—— Fused Deposition Modelling

2. Powder Bed Fusion

—— Selective Laser Melting

—— Selective Laser Sintering

—— Multi Jet Fusion

—— Electron Beam Melting

3. Vat Polymerization

—— Stereolithography

—— Continuous Digital Light Processing

—— Daylight Polymer Printing

—— Digital Light Processing

4. Direct Energy Deposition

—— Electron Beam AM

—— Laser Engineering Net

5. Material Jetting

6. Sheet Lamination

7. Binder Jetting

By Application Analysis

1. Prototyping

2. Tooling

3. Functional Parts

By End-use Analysis

1. Aerospace & Defence

2. Automotive & Transportation

3. Healthcare

4. Electrical & Electronics

5. Industrial

6. Consumer Goods

7. Power & Energy

8. Construction & Architecture

9. Others

Emerging Trends

1. Expansion of Industrial Applications

Additive manufacturing is transitioning from prototyping to full-scale production across industries such as aerospace, automotive, healthcare, and consumer goods. The aerospace sector, in particular, is leveraging Additive Manufacturing for lightweight components and complex geometries, while the healthcare industry is utilizing 3D printing for customized implants, prosthetics, and bioprinting applications.

2. Advancements in Metal Additive Manufacturing

The demand for metal-based additive manufacturing is surging due to its ability to produce high-strength, durable parts. Technologies such as Direct Metal Laser Sintering (DMLS) and Electron Beam Melting (EBM) are gaining traction, particularly in sectors requiring precision engineering. The adoption of new metal powders and alloys, including titanium, aluminum, and high-performance superalloys, is further expanding the potential applications of metal Additive Manufacturing.

3. Growth of Hybrid Manufacturing

Hybrid manufacturing, which integrates additive and subtractive manufacturing techniques, is emerging as a key trend. This approach enhances precision, reduces material waste, and improves the overall mechanical properties of components. Industries such as tooling and aerospace are increasingly investing in hybrid systems to achieve superior performance and efficiency.

4. Sustainable and Recyclable Materials

Sustainability is becoming a priority in the additive manufacturing industry, with a focus on eco-friendly and recyclable materials. Biodegradable polymers, recycled filaments, and sustainable metal powders are gaining attention as companies strive to minimize their carbon footprint. Additionally, Additive Manufacturing’s ability to reduce material wastage compared to traditional manufacturing methods supports global sustainability initiatives.

5. Advancements in Multi-Material and Multi-Color Printing

Technological innovations are enabling multi-material and multi-color 3D printing, allowing manufacturers to create complex, functional components with varied material properties in a single build. This advancement is particularly beneficial in medical devices, electronics, and customized consumer goods, where diverse material characteristics are essential.

6. Integration of Artificial Intelligence (AI) and Machine Learning

AI and machine learning are playing an increasing role in optimizing additive manufacturing processes. From automated design generation and topology optimization to predictive maintenance and quality assurance, AI-driven solutions are enhancing efficiency and reducing production errors. These intelligent systems are also contributing to improved material utilization and cost savings.

Regulations on Additive manufacturing Market

1. Safety and Quality Standards

Regulatory bodies worldwide have established stringent safety and quality standards to ensure the reliability and safety of products manufactured through additive processes. For instance, in the aerospace and automotive industries, components produced via additive manufacturing must comply with specific certifications like ISO 9001 for quality management systems and ISO/ASTM 52900 for terminology and classifications of additive manufacturing processes. These standards ensure that products are durable, safe, and fit for their intended use.

2. Intellectual Property Concerns

Intellectual property (IP) protection is a significant regulatory focus in the additive manufacturing industry. The ease of replicating designs and parts using 3D printing technology poses challenges to copyright and patent laws. Regulatory frameworks, such as those enforced by the World Intellectual Property Organization (WIPO), are crucial for protecting the IP rights of original designs and ensuring that innovation within the additive manufacturing sector continues to thrive without infringement risks.

3. Environmental Regulations

Environmental regulations are increasingly pertinent in the regulation of additive manufacturing. Agencies like the Environmental Protection Agency (EPA) in the United States and the European Environment Agency (EEA) in Europe have guidelines to manage the environmental impacts of 3D printing. These regulations focus on waste management, emissions control, and the use of sustainable materials. Compliance with these regulations not only supports environmental sustainability but also enhances community relations and brand image.

6. Healthcare Compliance

In the healthcare sector, additive manufacturing of medical devices and implants must adhere to rigorous regulatory standards. The U.S. Food and Drug Administration (FDA), for instance, has guidelines for 3D-printed medical products, emphasizing biocompatibility, sterilization, and clinical effectiveness. These regulations ensure patient safety and product efficacy, which are paramount in medical applications.

7. Future Regulatory Trends

As additive manufacturing technologies advance, regulatory frameworks are expected to evolve to address new challenges and opportunities. This could include more nuanced regulations concerning the use of biodegradable materials, further development of standards for additive manufacturing in emerging markets, and enhanced cross-border cooperation to standardize regulations and facilitate international trade.

Regional Analysis

In 2024, North America continues to dominate the additive manufacturing market, capturing over 38.6% of the global share, valued at approximately USD 8.6 billion. This leadership is driven by the strong presence of key industry players, rapid technological advancements, and significant investments in research and development. The United States and Canada are at the forefront, with the U.S. contributing a major share due to high demand in aerospace, automotive, and healthcare sectors.

Europe holds the second-largest market share, supported by a robust industrial sector investing heavily in Additive Manufacturing technologies. The European Union has implemented favorable policies to promote advanced manufacturing, with Germany, France, and the UK leading market growth. The region is expected to expand steadily as manufacturers increasingly adopt additive manufacturing for rapid prototyping and customized solutions, particularly in the automotive and healthcare industries.

In Asia Pacific (APAC), the additive manufacturing market is projected to grow rapidly, fueled by the expansion of manufacturing in China, Japan, and India. The rising adoption of 3D printing in automotive, aerospace, and electronics manufacturing is a key driver of market expansion. Additionally, government-backed initiatives supporting digital manufacturing and innovation are accelerating the adoption of Additive Manufacturing technologies across the region.

Latin America and the Middle East & Africa are emerging markets for additive manufacturing, with growth primarily driven by small- and medium-sized enterprises (SMEs) in the automotive and aerospace sectors. However, their market share remains relatively smaller compared to the leading regions, as adoption is still in its early stages.

Key Players Analysis

Leading companies in the Additive manufacturing market are adopting strategies such as innovation, partnerships, and geographic expansion to maintain their dominance. Key players include:

◘ Proto Labs Inc.

◘ Stratasys Ltd.

◘ 3D Systems Inc.

◘ ExOne

◘ EOS

◘ Materialise NV

◘ General Electric

◘ HP Inc.

◘ Renishaw plc

◘ SLM Solutions Group AG

◘ voxeljet AG

◘ Desktop Metal

◘ 3DCeram

◘ Autodesk Inc.

◘ Canon Inc.

◘ Dassault Systèmes SE

◘ EnvisionTec Inc.

◘ Optomec Inc.

◘ Organovo Holdings Inc.

◘ BASF SE

◘ Höganäs AB

◘ Arkema

◘ Other Key Players

Strategic Initiatives

◘ Product Portfolio Expansion: Companies are investing in R&D to develop advanced formulations that meet regulatory and consumer demands.

◘ Geographic Expansion: Focus on high-growth regions like Asia-Pacific and the Middle East to capitalize on industrialization trends.

◘ Sustainability Initiatives: Efforts to align with global sustainability goals and minimize environmental impact.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Distribution channels: Chemical Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release