MNI EUROPEAN MARKETS ANALYSIS: IMF Revises Up 2024 APAC Growth, Risks Balanced

- Cash ACGBs are 8-9bps richer on the day, with the AU-US 10-year yield differential 4bp lower at -19bps. RBA-dated OIS pricing is 9-10bps softer on the day for early 2025 meetings. Retail sales were weaker than expected in March falling 0.4% m/m with the decline broad based. Turnover is now up only 0.8% y/y, lowest since August 2021.

- AUD/USD faltered in the G10 FX space, while NZD was also an underperformer, with softer survey outcomes weighing. In China, PMI prints were mixed. China and Hong Kong equities are trading modestly weaker.

- The IMF sees Asia Pacific contributing around 60% to global growth in 2024. It revised up 2024 growth 0.3pp to 4.5% for the region in its economic outlook but still down from 2023’s 5.0%. The upgrade was driven by China, India and Australia.

- Later US Q1 ECI, February house prices, April MNI Chicago PMI and consumer confidence print. The ECB’s Buch speaks and euro area preliminary April HICP, and German, Italian & French Q1 GDP are released.

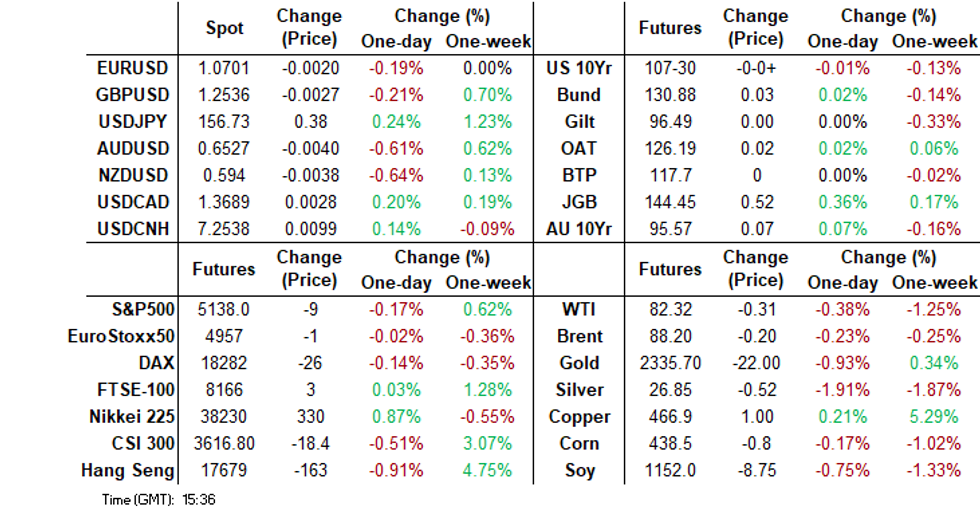

MARKETS

US TSYS: Treasury Futures Steady, MNI Chicago PMI and Consumer Confidence Later

- Treasury futures have been uneventful today, the 10Y briefly traded above Monday highs to 108-00 however we now trade back at 107-31+ while the 2Y is unchanged for the day at 101-15

- The cash treasury curve tighter with the 2Y yield -0.8bp to 4.968%, 10Y -0.8bp to 4.605%, while the 2y10y unchanged at -36.524

- Across local rates markets: NZGB yields are 5-6.5bps lower & ACGBs 7-8bps lower after weaker than expected Retail Sales numbers, while the JGBs curve has bull-steepened with yields 2bps lower to 1bp higher.

- MNI Fed Preview - May 2024: Analyst Outlook - (See Link)

- MNI BRIEF: Treasury Raises Q2 Borrowing Estimate By USD41B - (See Link)

- Looking ahead: Employment Cost Index, FHFA House Price Index, MNI Chicago PMI & Conf. Board Consumer Confidence later today, while major focus will turn to FOMC on Wednesday

JGBS: Futures Richer & Near Highs, Light Local Calendar Tomorrow

JGB futures are sharply and near session highs, +59 compared to the settlement levels on Friday, after yesterday’s public holiday.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined labour market, retail sales and IP data.

- (Bloomberg Opinion, John Authers) Authorities won’t confirm intervening on behalf of the yen because they know what really matters is being decided by the Fed. (See link)

- Cash US tsys are ~1bp richer across benchmarks, continuing the rally since Thursday’s Q1 PCE Deflator-induced low. The FOMC Policy Decision is scheduled for Wednesday, with policymakers expected to reiterate their commitment to maintaining higher interest rates for an extended period.

- Cash JGBs are richer across the curve, with yields 0.3-3bps lower. The benchmark 10-year yield is 2.2bps lower at 0.869% versus the YTD high of 0.930%.

- The swaps curve has bull-flattened, with rates 1-2bps lower. Swap spreads are wider out to the 10-year and tighter beyond.

- Tomorrow, the local calendar will see Jibun Bank PMI Mfg (F) data ahead of BoJ Minutes of March Meeting.

JAPAN DATA: Mixed Data, Labour Market Trends Appear Steady

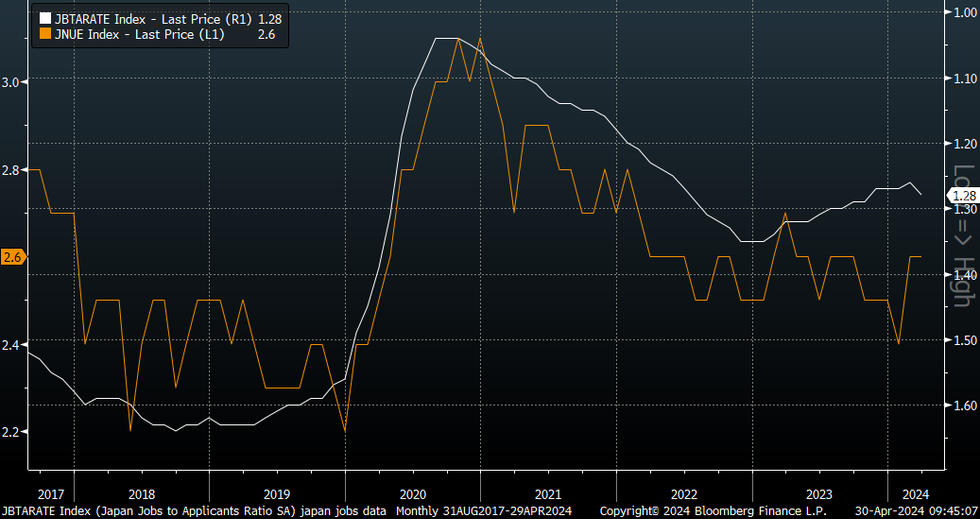

Japan's March job data was mixed. The jobless rate was at 2.6%, against a 2.5% forecast but unchanged from Feb's outcome. The job to applicant ratio was 1.28, against a 1.26 forecast and 1.26 prior.

- The broader labour market picture is unchanged compared to late 2023 trends, the chart below plots the job to applicant ratio (which is inverted on the chart) against the unemployment rate.

- Arguably we need to see much higher job-to-applicant ratio levels to bring about a lower unemployment rate (i.e. back to pre Covid levels).

- The detail showed a decent rise in the new applicants to job ratio to 2.38 from 2.26. Still, total applicants and job offers were down in m/m terms, with applicants off by more, hence the rise in the ratio.

- Other data showed retail sales for March weaker than forecast: -1.2% m/m and down to 1.2% y/y. IP was close to forecast at +3.8% m/m, but still -6.7% y/y. METI expects solid April and May gains for IP.

Fig 1: Japan Job-To-Applicant Ratio (Inverted) Versus Unemployment Rate

Source: MNI - Market News/Bloomberg

ASIA: IMF Revises Up 2024 APAC Growth, Risks Balanced

The IMF sees Asia Pacific contributing around 60% to global growth in 2024. It revised up 2024 growth 0.3pp to 4.5% for the region in its economic outlook but still down from 2023’s 5.0%. The upgrade was driven by China, India and Australia. 2025 is projected to slow moderately to 4.3%. It sees the risks to its forecast as “balanced’ and expects the region to experience a soft landing due to upcoming monetary easing.

- The key warning from the IMF was in regards fiscal policy. It advised governments to reduce deficits in order to make debt burdens and their servicing more sustainable so that structural reform can be financed.

- In terms of risks, spillovers from China’s property sector remain the key downside risk in the short term but higher than expected China stimulus or US/European growth are upside risks.

- China’s 2024 growth was revised up 0.4pp to 4.6% easing to 4.1% in 2025. India’s was increased by 0.5pp to 6.8%, Australia’s 0.3pp to 1.5% and the Philippines 0.3pp to 6.2%.

- Of the countries we cover, Japan’s expected 2024 growth was revised down 0.1pp to 0.9% and Thailand’s 0.5pp to 2.7%.

- The IMF notes that disinflation trajectories vary in the region with some experiencing deflationary risks and other inflationary. It warns central banks not to make policy “overly dependent” on US rates even if that helps to reduce FX volatility and “focus firmly on domestic price stability”.

- It expects elevated core inflation in Japan, Australia, NZ, Singapore and Korea this year, while Thailand and China should see it below in line with their negative output gaps.

- See IMF report here.

AUSSIE BONDS: Strong Session Instigated By Weaker Than Expected Retail Sales

ACGBs (YM +8.0 & XM +7.5) are 5bps richer after today’s softer-than-expected domestic data drop.

- Retail sales were weaker than expected in March falling 0.4% m/m after rising 0.2% with the decline broad-based. Turnover is now up only 0.8% y/y, the lowest since August 2021.

- The series is nominal and so impacted by inflation trends. Q1 volumes are published on May 7. This data aligns with the RBA’s assessment that “consumption growth is weak” but given sticky inflation and the robust labour market are unlikely to drive a change in stance.

- Private Sector Credit also surprised on the downside printing at +0.3% m/m versus +0.4% est and +0.5% prior.

- Cash US tsys are ~1bp richer across benchmarks, continuing the rally since Thursday’s Q1 PCE Deflator-induced low.

- Cash ACGBs are 8-9bps richer on the day, with the AU-US 10-year yield differential 4bp lower at -19bps.

- Swap rates are 8-9bps lower.

- The bills strip has bull-flattened, with pricing +3 to +10.

- RBA-dated OIS pricing is 9-10bps softer on the day for early 2025 meetings. The expected terminal rate falls to 4.40% (Sep-24) from 4.47% before the data.

- The local calendar will see CoreLogic House Prices and the Judo Bank PMI Mfg tomorrow.

- Tomorrow, the AOFM plans to sell A$800mn of the 3.75% May-34 bond.

AUSTRALIAN DATA: Retail Environment “Challenging”

Retail sales were weaker than expected in March falling 0.4% m/m after rising 0.2% with the decline broad based. Turnover is now up only 0.8% y/y, lowest since August 2021. The series is nominal and so impacted by inflation trends. Q1 volumes are published on May 7. This data is in line with the RBA’s assessment that “consumption growth is weak” but given sticky inflation and robust labour market is unlikely to drive a change in stance.

- All major components fell on the month, except for food retailing which rose 0.9% m/m. Clothing & footwear fell 4.3% m/m after posting two strong months while household goods fell 1.4%, the second straight drop and is the weakest in annual terms falling 3.2% y/y.

- The ABS said that retailers had told it that “overall trading conditions remain challenging” and that consumers are “cautious” as they face inflationary pressures.

Source: MNI - Market News/ABS

NZGBS: Closed Sharply Richer After Bus. Conf. Falls, Q1 Employment Tomorrow

NZGBs closed on a strong note, with benchmark yields 5-6bps lower, after Business Confidence fell to its lowest level since September last year.

- ANZ’s Business Confidence measure for April fell to 14.9 from 22.9 and the activity outlook to 14.3 from 22.5. Cost and wage pressures remained elevated with some easing only in the latter. Weak demand will make it difficult to pass on higher costs. The RBNZ needs activity to ease to return to inflation to target but this may be a slow journey.

- Swap rates closed 8-9bps lower.

- RBNZ dated OIS pricing closed 4-6bps softer for meetings beyond August. A cumulative 32bps of easing is priced by year-end.

- Tomorrow, the local calendar will see the Q1 Employment Report. The labour market is widely expected to have eased further with slower growth resulting in less hiring and migration increasing the labour supply and thus reducing pressure on wages.

- Bloomberg consensus has a 0.3pp increase in the unemployment rate to 4.3%, the highest in over 5 years, and forecasts employment growth to moderate to 0.3% q/q and 1.6% y/y from 0.4/2.4% in Q4. Unemployment expectations are between 4.1% and 4.5%.

- Private wages including overtime are projected to rise by between 0.6% and 0.9% q/q in Q1.

NZ DATA: Rising Costs As Activity Weakens Unlikely To Drive Higher Inflation

ANZ’s business confidence measure for April fell to 14.9 from 22.9 and the activity outlook to 14.3 from 22.5. While positive, both are at their lowest since September last year. Cost and wage pressures remained elevated with some easing only in the latter. Inflation expectations were stable at 3.8% but weak demand will make it difficult to pass on higher costs. The RBNZ needs activity to ease to return to inflation to target but this may be a slow journey. Rates are on hold for now.

- Cost expectations rose over 2 points to 76.7, highest in 7 months, which ANZ believes was driven by the pickup in oil prices and the softer NZD. Expected cost increases rose 0.3pp to 3.2% 3m/3m. As a result pricing intentions increased moderately to 46.9 from 45.1 with the expected rise over the coming 3 months up 0.1pp to 1.9%, driven by manufacturing.

Source: MNI - Market News/Refinitiv

- Wage expectations for the next 3-months moderated 0.4pp to 4% due to weakening labour demand and strong labour supply. The easing was broad based, which is good news for the RBNZ. Wage agreements over the coming year are also expected to moderate to 3% from 3.3%.

- The decline in business confidence and activity was broad based across sectors. Most of the growth indicators deteriorated in April suggesting it will more difficult to pass on rising costs to customers. Employment intentions fell to -0.9 from +3.5, the first negative since July 2023. Investment intentions fell to -3.5 from +3.9 and residential construction to -8.6 from +7.4.

- See ANZ report here.

Source: MNI - Market News/Refinitiv

FOREX: USD Recovers Some Ground, A$ Weighed By Retail Sales Miss

The USD has recovered some ground today, mainly against AUD and NZD, with yen also weaker. The BBDXY USD index sits up around 0.20%, last near 1260.70.

- AUD/USD is down 0.5% to 0.6530/35 during today’s APAC trading as weaker Aussie retail sales and China services PMI weigh on the currency, which is unwinding the 0.5% gain from Monday. We are just below 0.6441 support.

- Australian retail sales were weaker than expected in March falling 0.4% m/m after rising 0.2% with the decline broad based. They are now up only 0.8% y/y.

- Regional equities are mostly stronger, although China markets are lagging modestly. US Tsy yields are down around 1bps.

- NZD/USD has been dragged lower, with AUD, off 0.50% to just under 0.5950. We did have weaker NZ survey results, but only off recent highs.

- USD/JPY has climbed, but couldn't reclaim the 157.00 level. We were last near 156.75/80, around 0.30% weaker in yen terms. The market is testing the waters post yesterday's strong rebound amid intervention speculation. Earlier comments from Chief FX Diplomat Kanda stated the authorities are ready to deal with FX at any time of the day, but declined to confirm whether they intervened yesterday. Mixed Japan data outcomes didn't shift FX sentiment.

- Later US Q1 ECI, February house prices, April MNI Chicago PMI and consumer confidence print. The ECB’s Buch speaks and euro area preliminary April HICP, and German, Italian & French Q1 GDP are released.

ASIA EQUITIES: China And HK Equities Mixed, China PMIs Higher For 2nd Month

Hong Kong and China equities are mixed today, with Hong Kong equities continuing their outperformance, after China announced measures to support the HK market. China equities have displayed a subdued response to the consecutive increase in factory activity for the second month, suggesting that the country's economic recovery could still have legs. The HSI has outperformed the CSI300 over the past month by 3.89% and 6.26% since the announcement. Positive property markets headlines out over the weekend saw property indices surge on Monday with many now entering bull markets. Earlier China PMI data was out with a positive print in manufacturing PMI, the gauge now in the second month of expansion although services slowed from the previous month and came in below expectations.

- Hong Kong equities are slightly higher today with the HSTech Index little changed after breaking back above the 200-day EMA and is now up 14.5% from lows on the Apr 19th. The Mainland Property Index surged higher on Monday after positive headlines over the weekend, finishing the day up 3.35%, we a touch lower today down 0.35% while the wider the HSI is up just 0.10%. China Mainland equities have again underperformed today , with the CSI300 down 0.35%, although the index was able to closed above the 200-day EMA for the first time since August 2023, small-cap indices are performing the lower today with the CSI1000 and CSI2000 both down about 0 .90%, while the ChiNext is giving back some of Mondays gains, down 1.25%

- China Northbound had another double digit inflow of 11b yuan on Monday. The past 5-days saw just a single day of outflows, with a total inflow of 35b yuan. The 5-day average at 7.05billion, while the 20-day average sits at 0.48billion yuan.

- Property Indices surged on Monday after broader market rally, and as expectations of further easing of home purchase restrictions grow following a major city’s relaxation, with headlines such as "CHINA'S CHENGDU WILL NO LONGER REVIEW HOME BUYING QUALIFICATION" & "CHINA'S CHENGDU RELAXES HOME-BUYING RULES IN BOOST TO MARKET" - BBG helping push markets higher. While CIFI has reached an agreement with creditors to restructure its debt, potentially reducing principal by up to 85%. The proposal involves swapping existing debt for new notes and saw CIFI's shares surge 28% in Hong Kong trading. The Mainland Property Index was up as much as 5.8% at one stage on Monday finishing the session up 3.35%

- Dividend payouts by China's A-share listed companies for 2023 are poised to reach a record high, with 3,800 out of 5,160 companies having currently released annual reports and have planned to distribute 2.2 trillion yuan ($304 billion). The banking, telecommunications, and oil and coal sectors are among those with the largest dividend plans.

- Earlier, Composite PMI was 51.7, down from 52.7 in March, Manufacturing PMI was 50.4 vs 50.3 est, while Caixin China PMI Mfg was 51.4 vs 51.0 est and up from 51.1 in March.

- Looking forward, Hong Kong GDP on Thursday

ASIA PAC EQUITIES: Equities Higher, Samsung's Strong Earnings, Busy Data Day

Asian markets are higher today, it has been a busy session on the data front. Japan has returned from a break on Monday with indices up close to 2%, the yen stabilized following wild swings in the previous session with what looked to be intervention from the MoF on Monday, while earlier we Had Japan Job Data, Retail Sales & Industrial Production with Housing starts data to come. Elsewhere South Korean equities are higher, driven largely by strong earnings from Samsung Electronics, while earlier Industrial Production missed estimates by quiet some margin. Australia Retail Sales missed estimates, ACGB yields moved lower and New Zealand's Business confidence fell. Looking ahead we have Taiwan GDP and Thailand BoP Current Account Balance a bit later.

- Japanese equities are higher today, playing a bit of catch up after being closed on Monday, focus has been largely on the Yen after yesterday briefly trading above 160, before what looks like MoF intervention saw the currency rally 3% at one stage to now trade at 156.82, although it should be noted we are now trading back at levels from Friday. Earlier this morning we had Jobless rate coming in at 2.6% vs 2.5% for March, but in line with Feb, and Job-To-Applicant Ratio of 1.28 vs 1.26, while Retail Sales showed a dropped from Feb 4.6% to 1.2% vs 2.4% est and finally Industrial Production picked up in March coming in at 3.8% vs 3.3% est. The Topix is up 1.81% and has broken back above the 20-day EMA, while the Nikkei 225 is up 1.07% and is testing both the 20 & 20-day EMAs.

- South Korean equities are higher today, led by strong earnings results from Samsung Electronics after reporting a more than tenfold surge in its first-quarter operating profit compared to the previous year which marked the first time in five quarters that its chip business turned profitable. Earlier this morning, Industrial Production was 0.7% vs 4.6% y/y est, falling from 4.6% in Feb. The Kospi is 0.65% higher, now up 5.88% from recent lows and trading back above all major moving averages while the 14-day RSI have ticked back above 50.

- Taiwan equities opened lower but have been able to edge slightly higher as the day progresses, later we have GDP data due out with consensus at 6% up from 4.93% last quarter. The Taiex is up 0.20%, and has been one of the top performers in the region since the Israel/Iran conflict up 6.45% with technical indicators showing buyers are well and truly in control.

- Australian equities are slightly higher today, Gains in Miners have been offset by loses in Industrials and Energy names. The ASX200 is up 0.20% after recently bouncing off the 100-day EMA and now trades just below both the 20 & 50-day EMAs at about 7685.

- Elsewhere in SEA, New Zealand Equities are up 0.2%, earlier 1Q Job ads fell 5.4% q/q and ANZ Business Confidence dropped to 14.9 from 22.9 in March. Indonesian Equities are up 1.20%, Singapore equities are up 0.38% ahead of Unemployment data later, while Malaysian equities are down 0.20%

ASIA EQUITY FLOWS: Asian Equity Inflows Pick Up Led By Tech, Indonesia Struggles

- China equities have followed up on their largest northbound inflow on Friday with another double digit (11b yuan) inflow on Monday. Equity markets were higher, the CSI300 has broken and held above the 200-day EMA first the first time since early August. MNI wrote earlier this morning on China connect flows (See here) . Flow momentum is now positive across all moving averages with the 5-day average now 7.6b, 20-day average at 0.49b and the longer term 100-day average now 0.75B yuan.

- Taiwan equities have bounced off recent lows and now trade back above all major moving averages, there was a $1.1b inflow on Monday with the last 5 trading days seeing a total inflow of $2.1b. This week we have GDP later today and PMI on Thursday. The 5-day average is now $413m, the 20-day at -$251m, while the 100-day average is now $64m.

- South Korean equity flows have been mixed over the short to medium term, Monday saw a $350m inflow, while the Kospi was up about 1.20% and is now comfortably above all moving averages. The 5-day average is now $137m, the 20-day average to $83m and the 100-day average to $176m.

- Philippines equities have now marked three straight days of inflows and the largest day since Feb 7th, the past three days we have seen a total inflow of $27m. The PSEi has surged 5.70% from lows made on Feb 19th. The 5-day average is -$9.7m, the 20-day average is -$9.1m, while the 100-day average continues to edge lower now at $0.45m.

- Indonesian equities have now marked 18 of 19 days of outflows, with the single inflow just $400k. Monday saw an outflow, although in a positive note it was smaller than than the recent average, of just $24m, this now takes the total flows from the past 19-days to $1.28B. The 5-day average is now -$49m, the 20-day average is -$63m, while the longer term 100-day average is $11m.

- Thailand's SET continues to struggle to make any meaningful move higher with the index still trading below all 20, 50, 100 & 200-day EMA's, flows over the past three days have been positive, although medium to long term have showed no real direction. The 5-day average is $17.9m, 20-day average is $3.6m, while the longer term 200-day average is -$20.5m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| China (Yuan bn)* | 10.9 | 35.3 | 82.9 |

| South Korea (USDmn) | 351 | 688 | 13852 |

| Taiwan (USDmn) | 1135 | 2067 | -135 |

| India (USDmn)** | -285 | -503 | 39 |

| Indonesia (USDmn) | -25 | -245 | 523 |

| Thailand (USDmn) | 15 | 89 | -1852 |

| Malaysia (USDmn) ** | 22 | 61 | -608 |

| Philippines (USDmn) | 20 | -14.2 | 38 |

| Total (Ex China USDmn) | 1233 | 2143 | 11857 |

| * Northbound Stock Connect Flows | |||

| ** Data Up To Apr 26th |

OIL: Crude In Narrow Ranges As Waits For Gaza Deal & Fed Announcement

Oil prices have range traded during today’s APAC session as markets wait the FOMC decision tomorrow (see MNI Fed Preview) and news on a Gaza ceasefire agreement. The Fed will be monitored closely as any further indication that the first rate cut will be delayed further is likely to weigh on oil prices as the market fears soft demand. A ceasefire is likely to see the geopolitical premium decline further. The USD index is up 0.2%.

- Oil prices fell over a percent yesterday on prospects of a truce deal for Gaza and today those losses have been held. WTI is down 0.2% to $82.50/bbl off the intraday low of $82.43. Brent is also 0.2% lower at $87.07 after finding support at $87.00.

- US crude inventories fell sharply the week before last. Today API data for last week will be released with the official EIA numbers on Wednesday.

- Later US Q1 ECI, February house prices, April MNI Chicago PMI and consumer confidence print. The ECB’s Buch speaks and euro area preliminary April HICP, and German, Italian & French Q1 GDP are released.

GOLD: Rangebound Ahead Of FOMC Decision On Wednesday

Gold is 0.3% lower in the Asia-Pacific session, after closing 0.1% lower at $2335.66 on Monday.

- The yellow metal remains rangebound ahead of Wednesday’s FOMC decision, where policymakers are anticipated to reiterate their commitment to maintaining higher interest rates for an extended period.

- Historically, gold tends to react negatively to higher interest rates due to its lack of yield-bearing characteristics.

- Nonetheless, bullion is on track for a third straight month of gains due to strong central bank and haven demand.

- According to MNI’s technicals team, gold remains in consolidation mode. Having last week pierced the 20-day EMA, a continuation lower would signal scope for an extension towards $2238.8, the 50-day EMA. Key resistance and the bull trigger is at $2431.5, the recent Apr 12 high.

SOUTH KOREA DATA: IP Falters, Weaker Manufacturing Activity May Drive Downward Q1 GDP Revisions

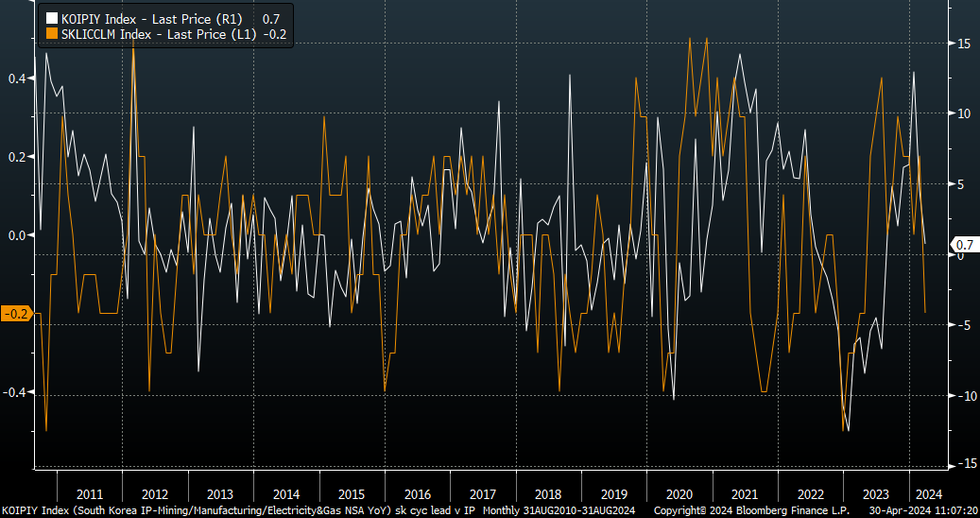

Earlier data showed March industrial production well below expectations. We fell -3.2% m/m, against a +0.5% forecast. Feb was revised down to a 2.9% gain from 3.1% initially reported. In y/y terms, IP growth was 0.7% (+4.6% forecast). This puts IP momentum back to Q3 2023 levels.

- In m/m terms it was the largest drop since end 2022. The Stats agency noted growth was coming off a high base.

- Still, the result places downside risks to the bumper Q1 GDP result (initially reported as a 1.3% q/q rise). Overall manufacturing activity fell in quarter, but the GDP report suggested it rose 1.2%.

- In terms of the detail chip production eased in the month, but there remains a large wedge between production in this sector versus the rest of production sub components.

- Other data released shows retail spending rose 1.6%, but construction investment was down 8.7%m/m.

- The cyclical leading index fell to -0.2 in March from 0.2 prior. It suggests some loss of economic momentum towards the end of Q1. The chart below overlays this index against y/y IP growth.

Fig 1: South Korea Cyclical Leading Index Versus Y/Y IP

Source: MNI - Market News/Bloomberg

ASIA FX: Most USD/Asia Pairs Higher, PHP Outperforms, Labor Day Holidays Tomorrow

Outside of PHP, most Asian currencies are tracking weaker against the USD at this stage. USD/CNY spot is back above 7.2400, continuing to be supported on dips. USD gains are fairly modest overall, but in line with G10 FX losses against the greenback. Tomorrow onshore China markets are closed for the start of a 3-day break. A number of other markets are closed around the region including Hong Kong and Singapore. Note we still get South Korea April trade figures (even with local markets closed).

- USD/CNH is testing back above the 50-day EMA, the pair last near 7.2535. Onshore spot has pushed higher since the open, last around 7.2430, just shy of recent highs. The CNY fixing was steady, but the onshore bias remains to buy USD dips. Weaker China equity sentiment has likely hurt at the margins, while PMI data was mixed. Services activity has pulled back, but remains in expansion territory, while manufacturing is showing some resilience.

- 1 month USD/KRW sits marginally higher, last near 1376.6, around 0.25% weaker in KRW terms. Overall, we continue to track recent ranges, We had weaker than expected IP data earlier, with downside risks for Q1 GDP revisions. The Kospi is higher, but away from best levels.

- USD/PHP is lower, last near 57.55, around 0.25% stronger in PHP terms. The peso is bucking the broader stronger dollar trend (BBDXY +0.20%) so far today. The pair has progressively moved away from recent highs near 58.00.• Recall last week we had comments from the BSP Governor that they were prepared to intervene in FX markets. This hinted that the 58.00 level was a potential short term line in the sand. This has potentially curbed further upside interest in the pair. Note we still sit away from support points, with the 20-day EMA back around the 57.13 level. The IMF noted in commentary today the local currency could face pressure from interest rate differentials.

- USD/THB holds above 37.00, displaying lower volatility in recent sessions. We had March IP fall -5.13% y/y, which was below expectations and continues the recent run of generally softer local economic indicators. Still to come is March BoP and trade balance figures.

- Spot USD/IDR continues to gravitate higher, the pair last near 16270. This is just short of recent cyclical highs of 16288. Dividend related outflows may be continuing to weigh. The general backdrop for offshore portfolio flows also remains negative. Watch for BI intervention if we threaten recent highs.

INDONESIA: INDON Sov Curve Flatter, IDR Bond Auction, Microsoft AI Investment

The Indonesian sov curve has bull-flattened again today with yields 1-4bps lower. Indonesia is scheduled to sell 5yr-30yr local debt shortly and is targeting a raise of about 23 trillion rupiah across the curve with most demand expected in the 5- and 10-year lines as yields both tradw above 7%.

- The INDON sov curve is flatter today, the 2Y yield is unchanged at 5.33%, 5Y yield is 1.5bps lower at 5.36%, the 10Y yield is 2.5bps lower at 5.425%, while the 5-year CDS is down 0.5bps at 75.5bps.

- The INDON to UST spread diff was little changed during the US session on Friday, the 2Y is now 34.5bps (-0.5bp), 5yr is 71.5bps (+2bps), while the 10yr is 81.5bps (+1bp)

- In cross-asset moves, the USD/IDR is up 0.10% at 16,268, the JCI is 1.27% higher, Palm Oil 1.78% lower, while US Tsys yields are flat to 0.5bp lower.

- Foreign Investors have sold $239m of Indonesian Bonds on Monday, the most in over a month, taking the total outflow for April to $1b in a shortened Month, with the 5-day average is now -$81m, vs the 20-day average at -$75m, while the 100 & 200-day averages are about -$8m.

- Microsoft's CEO announced a $1.7 billion investment in AI and cloud computing for Indonesia during a meeting with President Joko Widodo, aiming to bolster the country's tech infrastructure. Nadella also pledged to train about 840,000 Indonesians in AI, emphasizing Microsoft's commitment to the region's technological advancement.

- Looking forward, S&P Global Indonesia PMI Mfg and CPI on Thursday

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/04/2024 | 0530/0730 | *** |  | FR | GDP (p) |

| 30/04/2024 | 0530/0730 | ** |  | FR | Consumer Spending |

| 30/04/2024 | 0600/0800 | ** |  | DE | Retail Sales |

| 30/04/2024 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 30/04/2024 | 0645/0845 | *** |  | FR | HICP (p) |

| 30/04/2024 | 0645/0845 | ** |  | FR | PPI |

| 30/04/2024 | 0700/0900 | *** |  | ES | GDP (p) |

| 30/04/2024 | 0700/0900 | ** |  | CH | KOF Economic Barometer |

| 30/04/2024 | 0755/0955 | ** |  | DE | Unemployment |

| 30/04/2024 | 0800/1000 | *** |  | IT | GDP (p) |

| 30/04/2024 | 0800/1000 | *** |  | DE | GDP (p) |

| 30/04/2024 | 0830/0930 | ** |  | UK | BOE M4 |

| 30/04/2024 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 30/04/2024 | 0900/1100 | *** |  | EU | HICP (p) |

| 30/04/2024 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 30/04/2024 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 30/04/2024 | 0900/1100 | *** |  | IT | HICP (p) |

| 30/04/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 30/04/2024 | 1100/1200 |  | UK | Asset Purchase Facility Quarterly Report 2024 Q1 | |

| 30/04/2024 | 1230/0830 | *** |  | US | Employment Cost Index |

| 30/04/2024 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 30/04/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 30/04/2024 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 30/04/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 30/04/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 30/04/2024 | 1345/0945 | *** |  | US | MNI Chicago PMI |

| 30/04/2024 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 30/04/2024 | 1400/1000 | ** |  | US | housing vacancies |

| 30/04/2024 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 30/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 01/05/2024 | 2245/1045 | *** |  | NZ | Quarterly Labor market data |

| 01/05/2024 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |